African countries can catch up on exploration and output

Consensus points to continent being key part of mining’s future

Everywhere I go — whether working with US policymakers, London mine financiers or mining companies in emerging markets — the grievance is the same. Prices are terrible.

So, even though we have strong long-term demand signals everyone is feeling price sensitive. I thought it was passing. It’s not, at least any time soon. But those I speak to do have ideas on where prices could and should go.

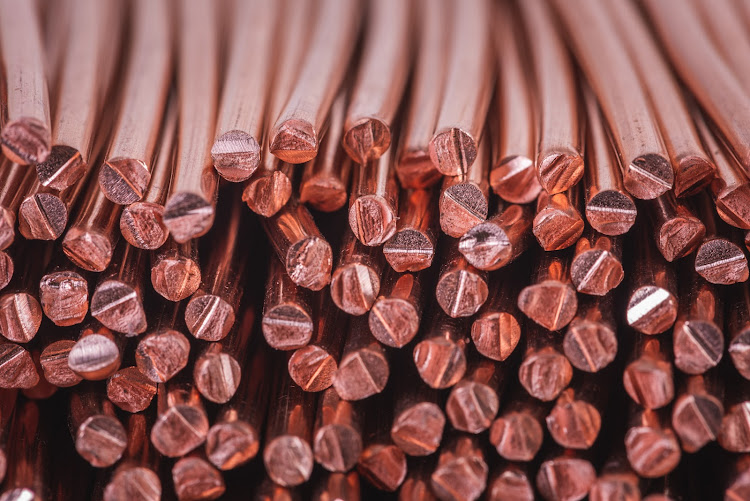

I was with a mine financier this week, who revealed that there is a commodity of choice. “You know, copper is the only commodity that people want to finance these days.”

As I was looking through mine exploration expenditures the other night (as one does when struggling to fall asleep), the numbers back his narrative, particularly in Latin America. There, a sharp increase in exploration has occurred over the past seven years, and the largest share has been in copper. For example, exploration spending in Chile increased 45% during this period, now reaching $833m.

The country received the fourth highest exploration in the world. It now produces a third of the world’s lithium, but it is copper that attracted 82% of exploration last year, while just 3% went to lithium.

Likewise, in Peru copper accounted for the largest share of exploration, contributing to 47% of all spending despite the country having large lithium and nickel reserves, each of which attracted just 11% of exploration.

In addition to commodity preferences, there are also jurisdictional preferences. Exploration companies are still by and large hesitant to spend in Africa. Seven of the top 12 jurisdictions for exploration spending were in South America. There are the usual suspects — Canada, Australia and the US — but Indonesia has also become a hotspot due to its nickel reserves.

It leaves me wondering: can African countries catch up on both exploration and production? Call me an optimist, but I think we are making strides. My mine financier friends tell me Namibia and Tanzania are attractive destinations and companies want to do business there. Tanzania’s new president is private-sector orientated and is turning the investment climate around.

SA is lagging, severely. Is it too late? Probably not. Countries like Tanzania and Zambia had terrible policies just a few years ago, including double taxation, resource nationalism, export restrictions and corrupt licensing.

Future of mining

To me Africa is the future of mining. There are largely untapped substantial reserves of platinum, manganese, chromium, cobalt, copper and graphite, among other resources. But it’s unfamiliar territory to non-Chinese investors. The West, particularly the US, has long focused on Latin America.

However, judging from the number of US officials who have visited the region, mineral production and processing companies, Africa is coming to the forefront. Slowly, perhaps too slowly, but it is getting there.

I’m often — several times a week — asked how the US election could swing US minerals engagement in African countries. The potential Republican administration is more averse to China than the current Democratic one, and it is highly transactional if it serves US national, economic and energy security interests. This means you would probably see greater US engagement on the continent, which can help drive production, value-added processing, industrialisation, revenue generation and job creation.

But this also requires a more concerted effort from African countries to have these conversations and engage. One thing is certain from my conversation with my mine financier friends in London: they want to go, but they must balance risk with geology for commercial return reasons.

Sound policies can begin to offset the world of volatile commodity prices. While they noted that Latin America is a safer jurisdiction from a financing and investment point of view, there’s also consensus that Africa is a key part of the future.